st louis county personal property tax lookup

Ad Find Anyones Tax Lookup Records. 800 am to 500 pm.

You Can Pay St Louis County Real Estate And Personal Property Taxes Online Fox 2

Payment will be accepted in the form of credit or debit card cash check money order or cashiers check for current year taxes.

. All Personal Property Tax payments are due by December 31st of each year. Personal Property Tax Declaration forms must be filed with the Assessors Office by April 1st of each year. Review the Personal Property Tax information and learn about the assessment process assessment rate dates waivers etc.

Click on the link to print the receipt. Louis County Auditor 218-726-2383 Ext2 1. Choose a search type.

Search by account number address or name and then click on your account to bring up the information. We look forward to serving you. Expert Results for Free.

Currently the assessment ratios applicable for real estate property in Saint Louis County are. 19 for residential properties 12 for agricultural properties and 32 for commercial properties. To declare your personal property declare online by April 1st or download the printable forms.

If you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or emailing propertytaxdeptstlouis-mogov. Originally built in 1894 it served the African-American community until 1931. Once your account is displayed you can select the year you are interested in.

We are committed to treating every property owner fairly and to providing clear accurate and timely information. This data is intended to be used for informal purposes only. If you are paying prior year taxes you must call 218 726-2383 for a payoff amount.

Louis taxpayers with tangible property are mandated by State law to file a list of all taxable tangible personal property by April 1st of each year with the Assessors Office. The Assessors Office assesses real and personal property keeps records of all real estate transactions and maintains a current record of property ownership in the City. Louis County Assessors Office is responsible for accurately classifying and valuing all property in a uniform manner.

The assessment is made as of January 1 for the current years tax and is predicated on 33 13 of true value. St Louis County Personal Property Tax Lookup. Enter Name Search Risk Free.

Residents can pay their Personal Property and Real Estates taxes through our Online Tax Payment portal. Louis County Parcel Tax Lookup. All City of St.

Advanced searches left. 1200 Market St Rooms 115 117. Louis Department of Health.

Search for your account by name address or account number click on your account to pull it up and then select the year for which you need the receipt. Paying Property Taxes with Debit Cards or Credit Cards All payments are processed through Official Payments Corp. Learn more about this Historic Schoolhouses move.

The office is comprised of three sections. Leave this field blank. Online declarations are available no later than the last day of January through April 1 of.

Address Parcel ID Lake Plat SecTwpRng. Personal property tax bills are also available online using the Personal Property Lookup. Just Enter Your Zip to Start.

Can be used as content for research and analysis. Search only database of 12 mil and more summaries. The mission of the Department of Revenue is to provide quality customer-centered information and services to taxpayers licensees and document recipients.

Obtaining and distributing funding to more than 200 public-serving agencies improving education public safety health infrastructure and economic growth and opportunity in St. Personal Property Real Property and Records Mapping. Home Page - St.

Louis Department of Health View the latest information about COVID-19 from the City of St. Collected from the entire web and summarized to include only the most important parts of it. When you click on the logo for your payment type you will be directed to the Parcel Tax Lookup screen.

LOUIS COUNTY MO November 10 2021 - Personal Property and Real Estate tax bills for 2021 will soon arrive is mailboxes for St. Louis County Assessors website for contact information office hours tax payments and bills parcel and GIS maps assessments and other property records. State Muni Services.

Ad Just Enter your Zip Code for Property Records in your Area. It is not intended for use in abstract work land surveys title opinions appraisals or other legal documents or purposes. Email full profile.

Historic African American Schoolhouse Moving to Faust Park. Your feedback was not sent. Missouri State Statutes mandate the assessment of a late penalty and interest for taxes that remain unpaid after December 31st.

View On Map Property Detail Report Print Tax Statement Pay Taxes. Search For Title Tax Pre-Foreclosure Info Today. For an official receipt which is accepted for license plate renewals and tax purposes please visit our Personal Property lookup.

Search by Account Number or Address. Be Your Own Property Detective. ST OF MN C278 L35.

This historic school building was recently rediscovered and is being acquired by the Foundation to be moved and restored in the Historic Village of Faust Park. Address Parcel ID Lake Plat SecTwpRng. Search Any Address 2.

Louis County residents and the county is encouraging people to avoid the line and pay online. See Property Records Tax Titles Owner Info More. Find Property Tax Records Get Accurate Home Values Online.

Home Blog Pro Plans Scholar Login. Site Search Alerts and Announcements COVID-19 Information. View the latest information about COVID-19 from the City of St.

Revenue St Louis County Website

Print Tax Receipts St Louis County Website

Online Payments And Forms St Louis County Website

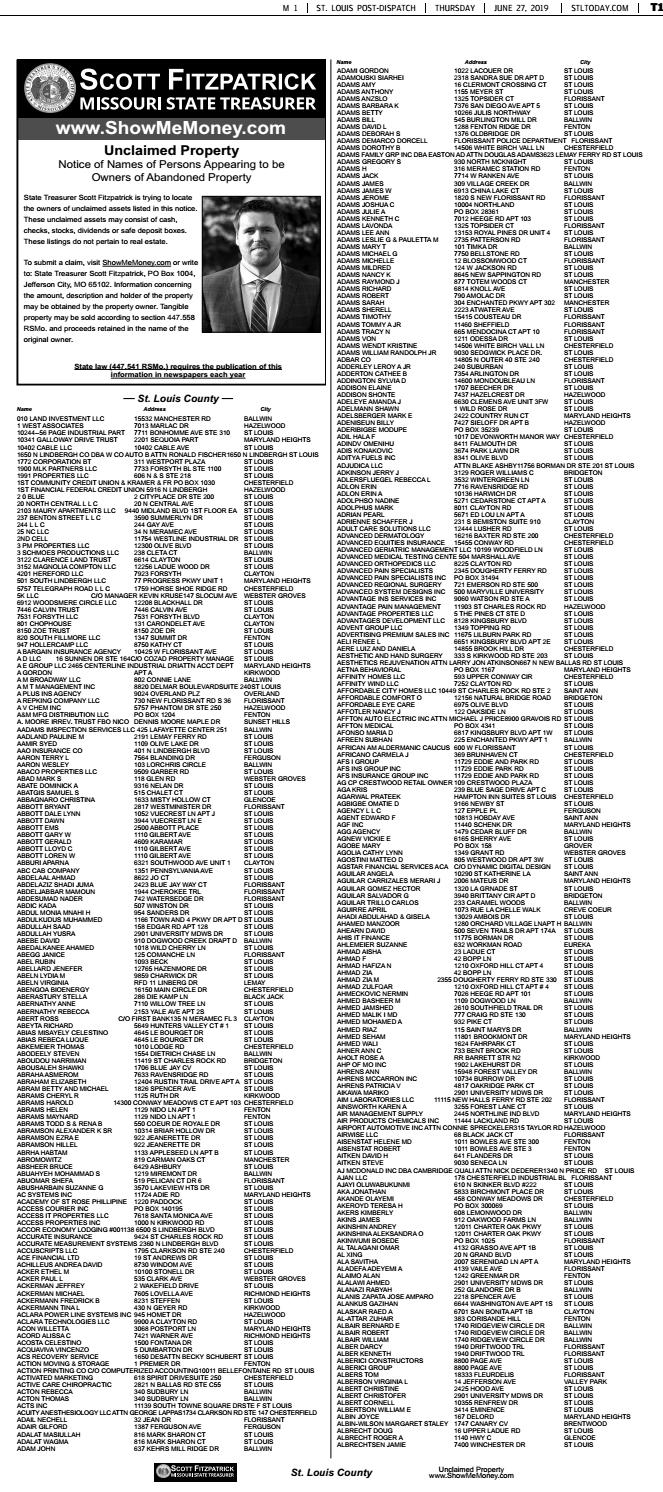

St Louis County 2019 By Stltoday Com Issuu